Keep The Change, You Filthy Animal

November 6, 2017

A Penny Saved Is A Penny Earned

November 6, 2017Pay Yourself First

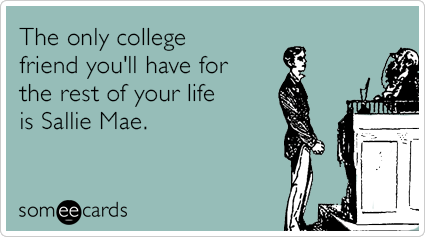

Pay yourself first: the golden rule of personal investment. This concept, most commonly used by financial planners, allows clients to automatically distribute their paychecks into their investment and retirement funds. Dollar Investment Club was created around this idea with a concept of set it and forget it. Why then does it become so difficult to actually do what we are trying to promote? It is interesting to think that people feel a need to pay off college loans as fast as they can, yet they have no problem with mortgages that go on and on and car loans that are perpetual.

Pay yourself first: the golden rule of personal investment. This concept, most commonly used by financial planners, allows clients to automatically distribute their paychecks into their investment and retirement funds. Dollar Investment Club was created around this idea with a concept of set it and forget it. Why then does it become so difficult to actually do what we are trying to promote? It is interesting to think that people feel a need to pay off college loans as fast as they can, yet they have no problem with mortgages that go on and on and car loans that are perpetual.

When young professionals get a little bit of extra cash, for example a bonus or a tax refund, they think the best method is to pay off debt they already own. WRONG. You need to always remember to pay yourself first. They come back and ask me but WHY? Here are six simple questions you should ask yourself before you decide to invest in your retirement fund over you student loans.

- Overall student loan situation: What is your overall situation? Are you able to pay your monthly payments? Do you have income surplus after ALL of your bills are paid including your student loan monthly payments? Do you have enough money saved up in an emergency fund? It’s good to know where you stand with your loans before making any changes. So before you can make any decisions make sure you know where you stand financially.

- Tax Benefit: Are you getting a tax benefit from your loans? Aka are you getting money back on the interest you paid on your loans during tax season? Any money that you contribute to your 401K or IRA are tax deferred which means you don’t pay taxes on your contributions until you take it out in retirement. So if you make $40,000 a year and you contribute $10,000 to your 401K the government will tax you on $30,000. Any money that you put towards your student loans comes from after tax dollars. So with the same example above, if you put $10,000 towards your student loans it would really only be $8,500 after taxes if you are in the 15% tax bracket. Assuming that you are going to grow in your career you will be moved to a higher tax bracket once you start making more income. If you anticipate this, then it makes sense to defer less and pay more of your taxes now upfront. For most of us, however, we don’t have money now to pay taxes upfront so we need to defer as much as possible until we reach retirement when we have more money saved up. For DINCs, it makes sense to defer that tax till we are able to pay it and for most cases, for tax purposes, it makes sense to deduct our student loan interest and lower our income by contributing to a retirement plan. (Plus more money back in April to put towards your retirement fund)

- Interest: If you are saving for retirement, interest is working for you. If you are paying off your student loans interest works against you. When you are trying to do both, these two interest rates are competing. Interest rates for student loans have been the lowest we have seen in 30 years. With that being said, you need to look at your retirement portfolio against your student loans… is the interest you are making on your retirement fund higher than your student loan interest? If yes, then you are making a profit and are better off taking the risk of investing your income surplus into your retirement. If not, then you better start paying of your student debt faster because that interest is set in stone until you are able to pay it all off. The market is volatile so there is no way to tell which will be the better decision in the long run but it is BETTER to take risks as a young investor then to wait and invest later in your career. (Not to mention this little thing called COMPOUND INTEREST what DINC is founded on)

- Employee Benefits: Is your employer giving you a percent or even matching what you put in your 401K? If so, you need to take advantage of this! This is FREE money that they are willing to give you and you should be putting in enough to match what they will give you. No brainer, invest in your retirement fund over student loans if this applies to you.

- Lower adjusted gross income: Adjusted gross income is your total income minus deductions. Your monthly payment for your student loans is based on your adjusted gross income. The money you put into your retirement fund is money that is not deducted from your AGI. Therefore, you can lower your monthly payments for your student loans based off your lower AGI.

- Risk: What it all comes down to is how much risks are you willing to take? While there is no definite answer to should I invest in my retirement fund or pay off my student loans, it’s good to understand all of the different factors that way in on your decision. Bottom line is: what works best for you? But remember you have to pay your student loans back whether you pay it back tomorrow or in five years. In those five years you retirement fund has potential to grow and compound interest. For me personally, I pay my monthly requirement for my student loans plus a little extra each month and at the same time I contribute the same amount to my retirement fund. For me that’s what works best! Paying off the interest faster on my student loans but still taking advantage of being a young investor. The most important thing to take away from this article is to always pay yourself first, your future self will thank you!