Beware the Guarantees

March 22, 2019

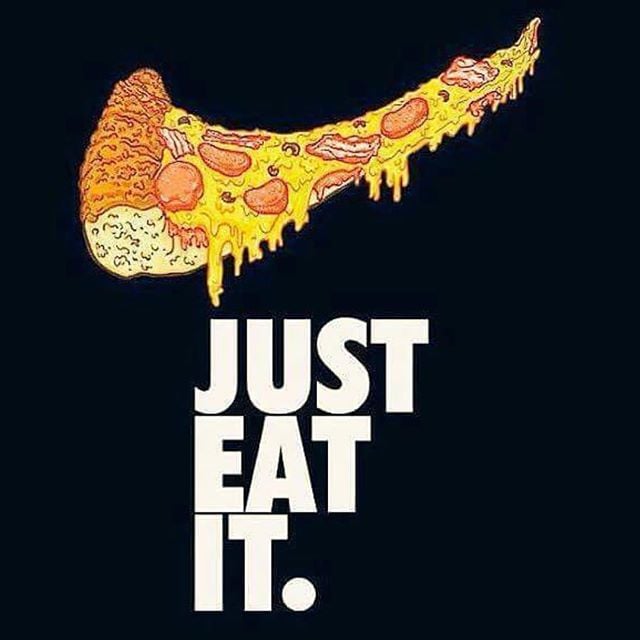

Food for Thought…

April 18, 2019Inversion Aversion

Several weeks ago traders took notice of the inverted yield curve (short term rates higher than longer term rates). Their concern is that every recession since the 1960’s was preceded by this inversion. But this may be a bull inversion as a more accommodative Fed and historic low rates around the world have kept the cost of money low, so the bull market continues, until it doesn’t. The other interesting inversion is the large number of unicorn IPO’s that are coming out in 2019, possibly a record number, and the huge amount of losses these companies are experiencing. In the past, private companies would create a product, get to market, have some profits and then IPO to access growth capital For this herd of unicorns, future profits will be the story for Wall Street to tell.