Stop Pressing Snooze

June 27, 2019

Spring Cleaning Money Saving Tip

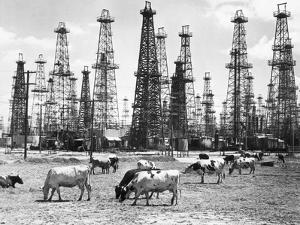

July 4, 2019Black Gold, Texas Tea

il prices were certainly in the news this past week as military tensions boiled up with Iran and a huge refinery explosion lit up the city of Philadelphia. Interestingly, even after Iran destroyed a US drone over international waters, the price of crude rose, but only to about $58 per barrel. Historically this type of overt aggression between the US and a Middle East country would have shot the price of crude up over $100 dollars a barrel or more. Why then, thankfully, is there such a muted reaction in the price of oil? One comforting notion, both to our safety and our economy, is that in 2019, the US may be a net exporter of oil for the first time. This is an important, if not largely talked about phenomenon. Refineries pose a separate issue, as the lack of investing in the US, puts them all at peak usage and none of them are getting any younger. As investors we need to understand the long term effects of energy independence paired with a dependence on aging refining infrastructure.