April 25, 2020

What a week for the oil markets. Have you ever been in that situation where a recently flushed toilet just keeps flowing and flowing as you desperately look for a way out of what could be a very bad situation? Oil traders had that feeling all week, especially on Tuesday, when the futures market actually went negative in a big way, closing at -$38 dollars a barrel. As the world shut down continues and oil continues to flow, there is now nowhere to put it. This just another dramatic example of the unintended consequences to our economy by literally shutting us all at home. Negative oil, negative interest rates, record unemployment, what next? Actually, this will be the first year in history where social security benefit payments will outstrip social security tax revenue. We all need to do our best to get the economy back up and running, as each day is more important than the previous. “We got no food, we got no jobs, our pets heads are falling off…”

May 22, 2020

As we begin the summer season, and the country begins to get out of the house and back to work, the headlines continue to address the record unemployment level which now stands at around 38 million. The nature of this financial crisis appears to be different than in the past though. Looking at the bright side, many of those unemployed are actually furloughed, which means the jobs are not gone forever à la 2008. In addition, many of those on unemployment are strangely making more than when they were working. Finally, there are still 130 million people working, with extra Cares Act money in their pocket. Once again, the key to whether our recovery looks like a V or a Nike swoosh is how quickly and safely we open the economy back up. Enjoy your dogs this weekend and then we get back to work.

May 29, 2020

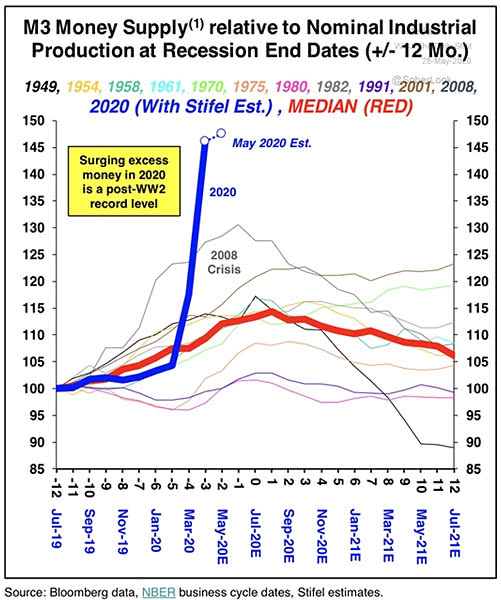

The markets have staged quite a strong rally from the lows of mid-March. While 25% of the work force still remain out of work and the economy begins to open up, investors seem to be amazed at the strength of this rebound from the depths of the pandemic induced financial crisis. One just has to look at the M3 money supply curve in comparison to other recessions to see how and why this market can bounce and in a big way in the short term. Long term, who cares? We have an election to worry about.

July 1, 2020

It is halftime for 2020, as we just finished one of the most volatile 2 quarters in history. From hugging out all-time highs in February to a devastating 30% drop in March as investors shunned stocks and each other, we have now rebounded in the second quarter to get back much of those losses. As a result of the pandemic, trends that took years or decades just happened in a matter of weeks. Think about it, since March half of all Americans employed are now working remotely and we viewed over 6 billion hours of Netflix in April alone. Companies that adapt to the new normal could be the long-term winners from a very bad situation. According to Goldman Sachs, we all still need to do our part, as their research shows that wearing masks could substitute for some of the potential closings from Covid-19, and prevent a 5% hit to GDP, or one trillion dollars just from covering your face.

July 16, 2020

I have a friend, yeah that’s it, a friend, who was very grateful for the occasional pass-fail course in higher education that helped make that term. We are in the middle of what could be called the “Pass Fail” market. The stock market, with almost half of the S&P 500 now not offering earnings guidance, is in a sort of financial no-man’s land. With the cover of sales and revenue unknowns combined with the universal blame of Covid-19, the coming quarterly reports will feel more like a beauty pageant than a fundamental deep dive. Hold on, because the markets might be heading on a road trip to volatility.